Farm Financial Analysis Series: Cash Flow Statement

Financial statements are essential tools for managing farm businesses. Often, an accountant or bookkeeper will produce statements from the financial records of the business. Although the manager or owner may not be the person who develops the statements, they should understand the information that the statements provide about the financial condition of the business and be familiar with actions they can take to improve poor financial performance.

To ensure that you get a full picture of the farm’s financial situation, use this publication in combination with the other financial analysis tools found in the Farm Financial Analysis Series. This series includes P3709 Managing Farm Finances in Turbulent Times, P3713 Balance Sheet, P3707 Income Statement, and P3712 Ratios to Measure Farm Financial Health.

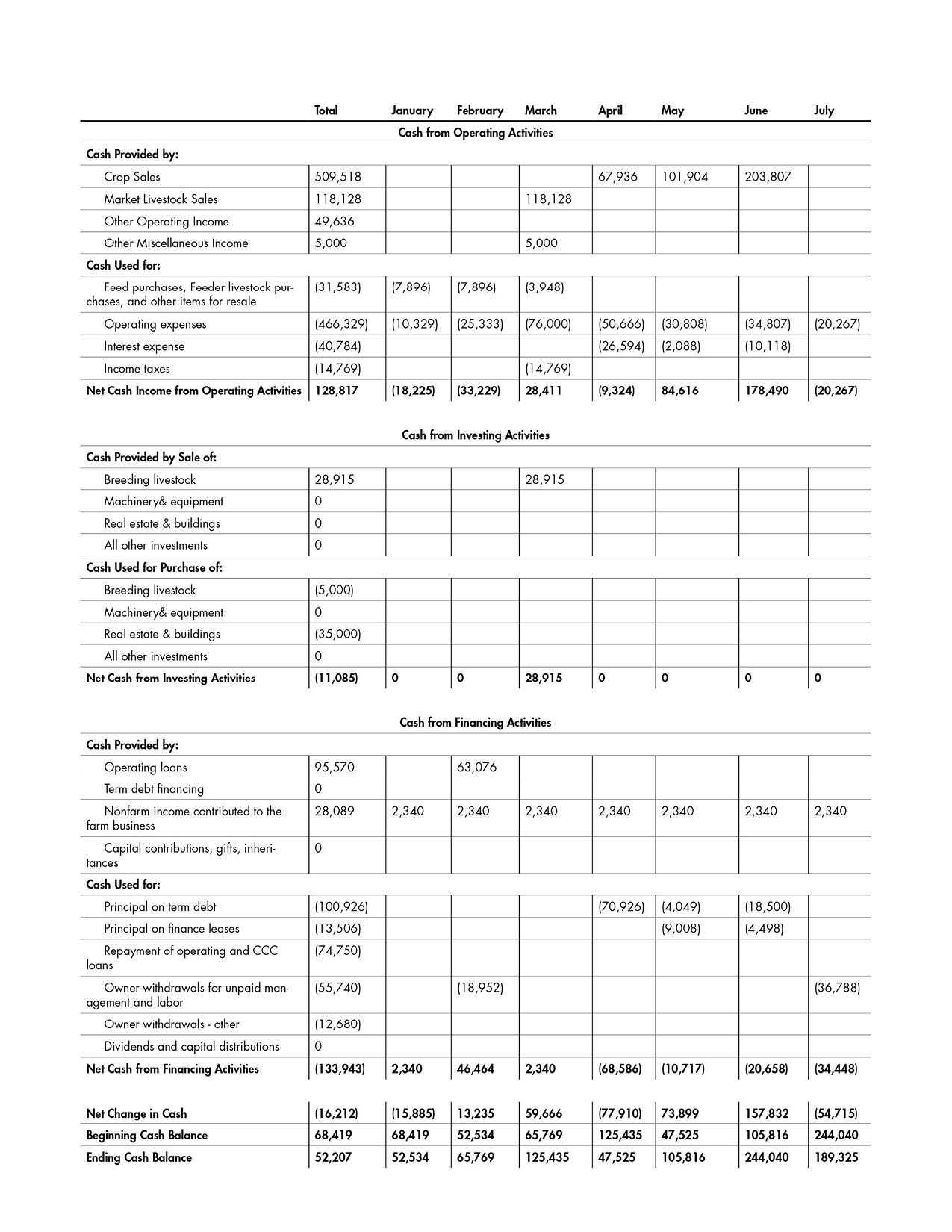

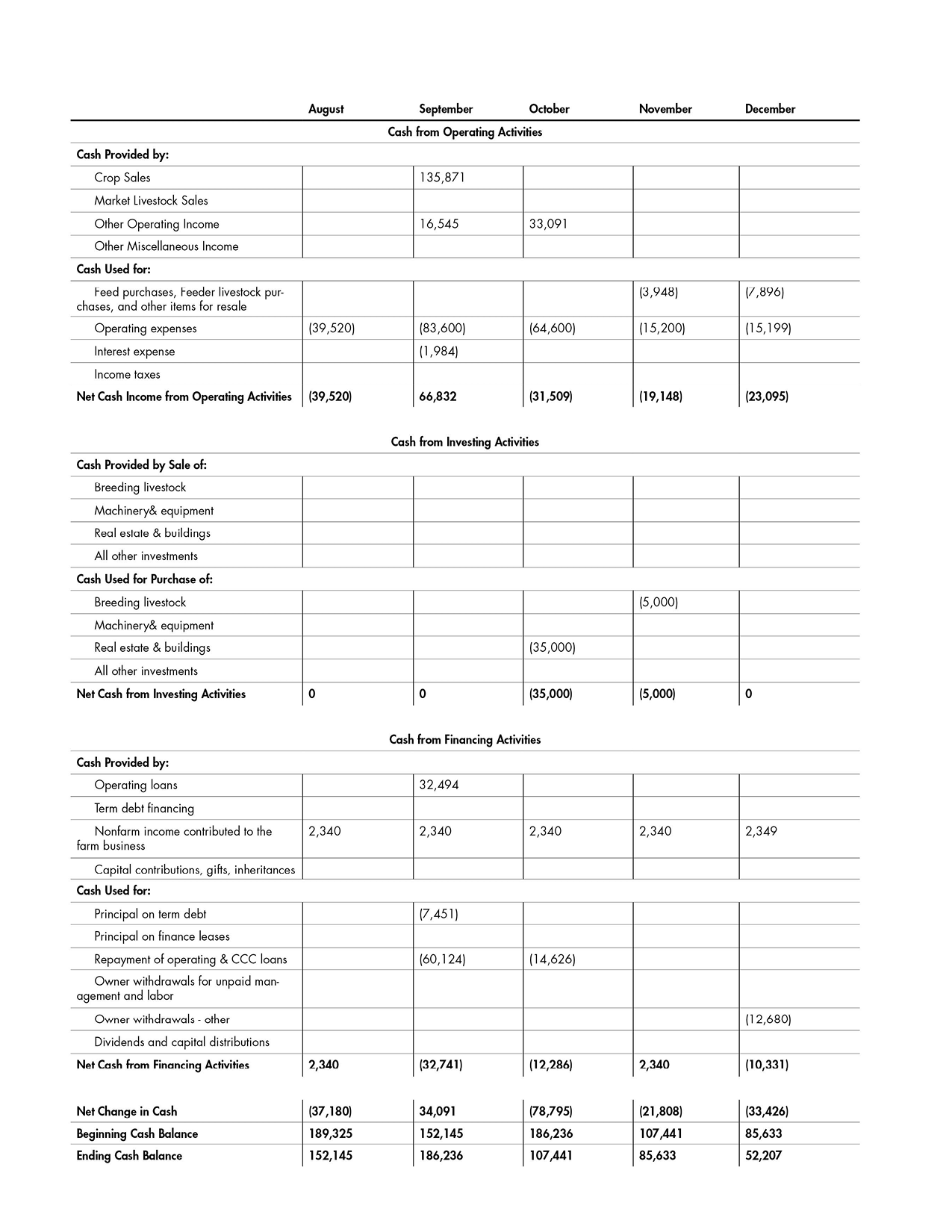

A cash flow statement is a record of all cash inflows and outflows that occur throughout the accounting period. This allows you to see how your available cash varies across the year. Understanding when financial obligations are due throughout the year and preparing for these periods going forward is essential.

Creating a Cash Flow Statement

The cash flow statement can be used to record monthly cash flows (see Figure 1), or it can be done bimonthly, quarterly, or semiannually. However, the more detailed the cash flow statement is, the easier it is to understand when cash is moving in and out of the business. The following items outline what to include in a comprehensive cash flow statement.

Cash from Operating Activities

The cash from operating activities section includes receipts from any sales of crops or market livestock. Other operating income would include amounts from agricultural program payments, like the Agricultural Risk Coverage (ARC) or Price Loss Coverage (PLC) programs. This section could also include payment for any custom work you completed.

Also, include all expenses for operating activities—any money spent on feed or items intended for resale, such as feeder livestock. This section also includes operating expenses, which are costs that help the farm operate. Operating expenses include spending on labor, chemicals, fertilizers, fuel, seed, or marketing. Interest expense is also included, representing interest paid on any loans. Lastly, any income taxes paid should be recorded here.

The net cash income from operating activities is all the cash from sales or other operating income minus all the costs of running the farm. The cash flow shows when incoming cash will be higher than expenses and when it may be lower.

Cash from Investing Activities

This section covers cash earned or spent on investment items. Any item typically used for longer than one year is considered an investment item, including any sales or purchases of breeding livestock. Purchases or sales of equipment or real estate are also included. The net cash from investing activities is the cash earned from investment items minus the cash spent on them.

Cash from Financing Activities

The cash provided by financing activities includes any cash received from operating loans or term debt financing. Any non-farm income used to pay for farm expenses is also included. Lastly, any gifts or inheritance, along with investment income, sales of personal assets, and retirement account withdrawals, are included.

Record the cash used to pay for any financing debt in this section. This includes payments on the principal of term debt, finance leases, and operating and CCC loans. Also, record any owner withdrawals for unpaid management and labor.

Cash Flow Summary

The cash flow summary shows all the cash received from operating, investing, and financing minus all the cash expenses for each month. The beginning cash balance is the amount of cash available at the beginning of each month. The ending cash balance is calculated by adding the beginning cash balance to the month’s net cash income from operating activities, net cash from investing activities, and net cash from financing activities. The net change in cash indicates which months have the most cash going in or out of the farm business.

How Can a Cash Flow Statement Help You?

A cash flow statement is a valuable tool for understanding when loan payments need to be made and when additional borrowing will be necessary throughout the year. The cash flow can help establish a loan repayment schedule that aligns with incoming farm revenue, which is important for both the farmer and the lender. This financial tool also helps determine when and if an investment can be made during the year.

You can use information from the cash flow statement to identify liquidity issues. If cash inflows are insufficient to cover business expenses and the operating loan is higher at the end of the period than at the beginning, there is a liquidity problem. Use the cash flow statement to assess which expenses can be adjusted to reduce this issue. In combination with the balance sheet and income statement, the cash flow statement is a useful tool for determining a farm’s financial situation.

Publication 3710 (POD-09-24)

By Brian Mills, PhD, Assistant Professor, Kevin Kim, PhD, Assistant Professor, and Jeff Johnson, PhD, Extension/Research Professor (retired), Agricultural Economics.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.