Small Business Finances: A Guide for Youth

This publication is designed to help youth have a general understanding of the basics of small business financial management and planning, business accounting and recordkeeping, and business financing. Planning for the financial aspects of a business can help you determine if the business idea has the potential for generating profit. Managing cash flow and creating a business plan are vital to a business’s success.

Part 1: Financial Management and Planning

Before you begin developing a marketing plan, it is important to first be sure the purpose and direction of your business, event, or product you are intending to market are clear. In this section, we will focus on the purpose of your business, what makes your business unique, and where you want to go as a business.

Financial management involves all the activities that help a business:

- Plan how to obtain resources to run the business and how to distribute these resources more efficiently

- Increase the profitability of the business

- Monitor the financial health of the business by keeping accounting records and analyzing financial information

Financial management helps you, as the business owner, know if your business idea is profitable, gives you information to determine the price of your products, helps you identify financing needs and how much debt you can afford, and gives you information to plan for the future of your business. Keeping good financial and production records is key for good financial management.

Why is financial planning important?

A financial plan gives business owners a roadmap for their money and their business. It requires analyzing costs and income, and determining a course of action for their business. Some important elements to analyze and include in your plan are:

- Resources (capital) needed to operate

- Income (sales) projections

- How resources will be used

- Breakdown of income and debts

- Cash flow projection

A plan can help you identify how much money you need, sources of money to run your business, how to use the money in the best way, and how to generate money with your business. Planning also requires anticipating and preparing for emergencies―for example, setting money aside for emergencies.

Many businesses fail because they do not have a plan in place. Planning helps reduce the uncertainty businesses often face by having enough funds to react when market conditions change or an emergency or disaster occurs (like a hurricane or flood).

Enterprise profitability

As a business owner, you need to examine if your business idea is profitable—that is, whether you can make money with your idea. To do that, it is important to identify the resources needed to run the business and the cost of producing your products or services. To be successful, a business needs to generate enough revenue (sales) to cover all the costs.

Profits (also known as net returns or the bottom line) are calculated by subtracting all the costs from your revenue.

Profits = Revenue - Costs

Revenue is all the income your business gets from the sale of products or services. Costs include all the expenses of running your business, which includes the cost of producing your products and the cost of running your business (for example, rent, insurance, utilities, and paying off interest on debt).

It is important to analyze the profitability of individual products and services. For example, if you grow tomatoes and cucumbers, it is important to determine the profits for each product.

Next, we will review how to develop a budget, which will be useful for identifying the cost of your products.

Budgeting

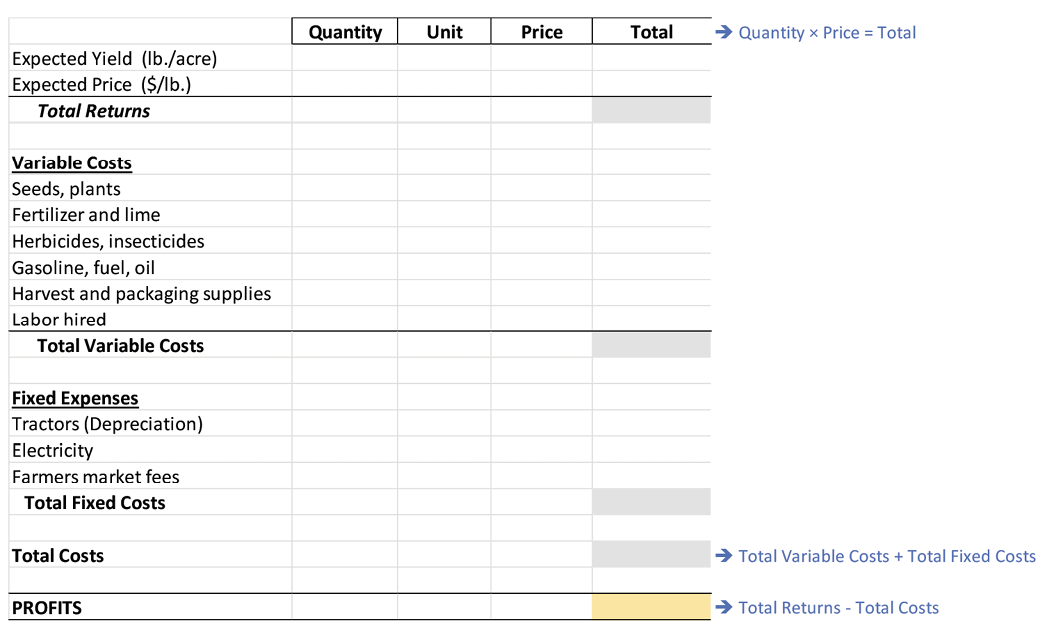

A budget is a management tool that helps you organize and account for the expenses of your business. In a budget, you list the sources of income (revenue) and inputs needed for production.

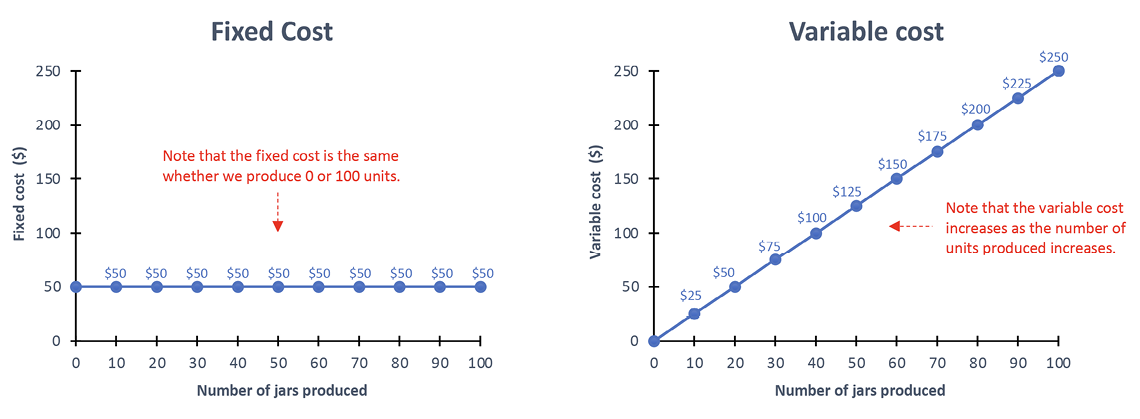

To develop a budget, first list all the expenses involved in running your business and classify them as 1) direct costs (also known as variable costs), and 2) fixed costs. Keeping good records is key to developing good budgets.

- Direct or variable costs: These are the expenses directly related to the production of your products or services and vary with the level of production. Below are some examples of direct costs for a farm operation growing vegetables and for an operation that sells jellies:

Vegetable farming

- Seeds

- Fertilizer and pesticides

- Fuel

- Field labor (harvest)

- Packaging materials (boxes, containers, trays)

Cottage food operation (jelly)

- Raw materials/inputs (fruit, sugar, pectin)

- Packaging and labeling materials (glass jars, labels)

- Production labor

When you know the direct cost of producing your products, you can divide the total cost by the total production output to determine the variable cost per unit.

Example: If you produced 1,000 pounds of marketable tomatoes in a small plot and you spend $700 to pay for production inputs (seeds, fertilizers, etc.):

variable cost per unit = $700 / 1,000 pounds = $0.70 per pound

- Fixed costs (also called overhead cost): These are expenses that do not vary with the level of production. These expenses are needed to run the business but are not directly related (attributable) to the production of products. Some examples are:

- Mortgage

- Rent

- Utilities (water, electricity, gas, internet)

- Insurance

- Taxes

- Interest expenses

- Marketing expenses (for example, a fee to sell at farmers markets)

- Depreciation on equipment

You can develop a budget for your entire business and an enterprise budget for each crop or product you have. Enterprise budgets, which are budgets for each product, service, or business unit, are useful for identifying the cost of producing each product. You can then use these enterprise budgets to price each product and determine if the product is worth producing.

Here is an example of the general items included on a crop budget:

Example: Variable and fixed costs

Imagine you are producing strawberry jelly to sell at the farmers market. Your estimated monthly costs are as follows:

- Variable cost per unit: Strawberries (fruit used in each jar; $0.50) + Sugar ($0.20) + Glass jar ($1.50) + Label ($0.30) = $2.50 cost to produce each jar

- Fixed cost = $50 (farmers market fee and flyers printed to advertise business)

Exercise

- Think of a business idea you have. It could be growing crops, selling other agricultural products, or something else!

- Determine what inputs you will need to produce your product and what it will cost. Visit www.extension.msstate.edu to identify how to grow and produce products such as produce, honey, jellies, salsas, and more. Work with your county Extension agent to answer all your production questions.

- Determine the costs of running the business and classify them as variable or fixed costs. Remember: Variable (direct) costs include all the supplies needed to produce the product, and fixed (overhead) costs include all the costs of running the business.

Determining your price

To price your products, it is important to first know your production cost (variable costs) and the cost of running your business (fixed or overhead costs). Good budgeting is extremely important!

Break-even point (price)

A good step toward determining your price is estimating the break-even price, which is the minimum price that will allow you to cover all your costs. This tells you the minimum price you can charge for your product to at least cover your costs, but not make a profit.

Break-even price = Variable cost per unit + fixed cost allocated per unit

Example

Let’s imagine you have a tomato crop and expect to produce 1,000 pounds of tomatoes. You expect to spend $700 in production inputs (this is your variable cost). You estimate that the fixed or overhead cost of your small tomato operation is $200 (a fee to be able to sell at the farmers market each week, gas to drive to the farmers market, and insurance).

- The variable cost per unit is = $700 / 1,000 lb = $0.70 per pound

- The $200 were not spent in producing tomatoes but were expenses needed to run your business. We will divide that expense by each pound of tomatoes ($200 / 1,000 lb = $0.20 per pound). In this example, we only produce tomatoes, but you can produce different products. In that case, you would divide your fixed costs across all those products.

Break-even price = $0.70 + $0.20 = $0.90 per pound

So the minimum price you can charge to cover all your costs is $0.90 per pound of tomatoes.

Now, you can decide how much more above the minimum price of $0.90 per pound to charge for each pound of tomatoes. Anything above the break-even price is your profit. Here are some considerations when deciding your final price:

- Competition: For example, how many other farmers are selling tomatoes at the farmers market, the volumes they have available, the quality of their product, and their prices. If there are many competitors and/or a lot of similar products available, it may be more difficult to raise your price. If the quality of competitor products is lower or higher than yours, you may be able to charge a premium or discount relative to their price. If competitors are raising or lowering their prices, you may have to raise or lower your price to meet the competition.

- Your product: The quality and presentation of your product.

- The place where you are selling your product: Prices tend to be different if you are selling at a farmers market (directly to the consumer) than if you are selling large volumes for wholesale distribution.

Resource

Listen to “Marketing Principles for Small Specialty Crop and Value-Added Producers” to learn about the factors to consider when setting your prices. In this video, price is discussed as part of the marketing mix for a business.

Part 2: Small Business Accounting and Bookkeeping

Recordkeeping is a key aspect of managing the finances of a business. Recordkeeping consists of maintaining, organizing, and classifying business records.

We tend to think that we will be able to remember all the details about our business, such as when we planted crops, how much we produced, and how much we sold our products for. But this is not the case.

Why is recordkeeping important?

- Income tax preparation

- Determining production cost and pricing products

- Evaluating business performance and informing business decisions

- Obtaining loans

- Insurance purposes

It is important for any business to have a system in place for keeping good records of all business activities, expenses, and sales generated. Records are important to evaluate the health of the business and develop financial statements. In managing a business, it is necessary to keep track of all expenses and revenue (sales) to determine if you are making a profit.

There are different types of records that any business needs to keep.

Financial records

- Income/Revenue: Money received from sales or services (what was sold, when, how much, and where)

- Expenses: Money paid for inputs and services

- Assets: All your physical and monetary values (buildings, land, cars, machinery, tools, cash, money in the bank, etc.)

- Liabilities: Money you owe

Many banks offer online checking accounts that you can use to monitor your spending and your deposits.

Production records

For example, in farming, you could keep records of field size, crops, land preparation, inputs used, irrigation, chemical applications, harvest dates, and amount and quality of product harvested.

Other records

Other records you need to keep include licenses, permits, contracts, and any other legal documents.

Note: While businesses tend to keep track of information for tax purposes only, it is important to keep records for more than taxes. Business decisions should be based on an analysis of the information contained in your records. For example, you may find that a specific crop variety did not have good yields and customers did not pay a good price because of its lower quality. Based on these records, in future years, you may choose the crop varieties that have performed better and have been more profitable for you.

Recordkeeping

- Determine what records you will keep and who will be responsible for keeping those records and managing business finances. This person will be in charge of recording day-to-day business transactions and other production information.

- Determine what resources you will need to maintain these records and how much this will cost. There are different recordkeeping systems you could use:

- Handwritten/paper-based recordkeeping using a financial ledger or book. This is not the most effective way of keeping records as you will have to do your own calculations, and it is more likely to have errors. However, it is low-cost and easy to implement.

- Computer-based system:

- You can use Excel spreadsheets to keep your records. You can develop your own forms or adapt forms available online. This is a low-cost system.

- There are other accounting software programs that you could buy to keep records and develop your financial statements. Some commonly used programs include Quicken and QuickBooks. You can use a computer, phone, or iPad to use these recordkeeping programs.

Take-away points

- Keep records of day-to-day transactions and production information.

- Identify a recordkeeping method that works well for your business.

- Good records are key to good financial management.

Resource

Listen to “Farm record-keeping principles for financial management.”

Part 3: Identifying Resources and Capital Needs

Identify what resources are needed to run or grow your business. Resources are needed to pay salaries, buy inputs and materials, pay for repairs, buy new equipment, replace old machinery, and so forth.

You need capital to get started with your business idea and cover these expenses. You may have some money to invest, but many times businesses also need to borrow money from a bank to be able to cover these expenses.

The 3 Cs of business financing: Cash, capital, and collateral

In any business, it is important to manage the financial aspects carefully. To do this, you must understand cash, capital, and collateral.

Cash

Cash is needed for a business to operate. When we talk about cash, we also need to think about money in the bank that can be used to pay for things with cash, by writing a check, or paying for credit card purchases. Having cash on hand (or in the bank) to purchase items you need or make change when a customer makes a purchase (for example, at the farmers market) is very important. Note that if a credit card is used in your business, you must make sure to have the same amount of money in the bank to pay it back.

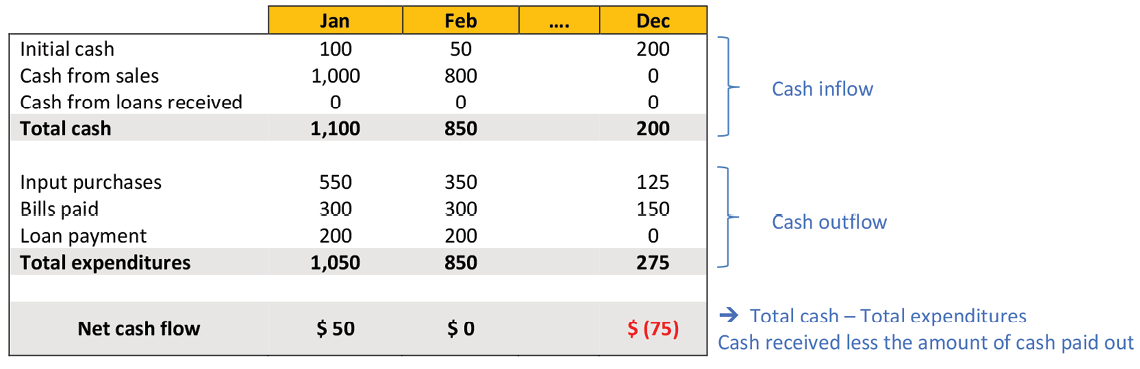

You can use a cash flow statement to manage the cash aspect of your business. A cash flow statement helps track money moving in and out of the business over a period. A cash flow statement (also called a cash flow projection) has two main parts:

- Cash inflow = Cash received from sales or money borrowed

- Estimate when you expect money to flow into your business and keep track of income you expect (sales) every week, month, or quarter. For example, a cash flow statement can track when you will get paid for certain items or services that your customers have purchased.

- Cash outflows = Cash paid out to cover expenses

- Estimate when expenses will occur, how much they will be, and when you will need to pay for these expenses.

A good cash flow statement can help you determine if you will be able to keep your business running smoothly while paying your bills. A cash flow statement can be set up to represent your business’s estimated cash flow by week, month, or quarter. Here is an example of a monthly cash flow statement:

Working Capital

Working capital is the money used for a business’s daily operations. Capital can be used to make purchases for the operation of a business. Capital can be acquired from multiple sources such as your personal assets, friends or relatives, banks, investment companies, and grants or loans from different organizations. When developing a business plan, you should determine how much capital is needed to start the business and if you have access to this amount of capital.

If you do not have the working capital to start a business, you could ask the bank for a loan. To obtain a loan from a bank, you will need to present a business plan to the lender. Having a budget and projections of your future income is important to demonstrate to lenders that you will have enough money to pay your loan back.

Collateral

In some cases, loans require assets (collateral) to be pledged as a guarantee in case the loan is not paid back. Those assets (collateral) can be used to pay back a lender for the money that has been borrowed. According to Michigan State University Extension, lenders typically expect a borrower to have assets that can be used as collateral in order to get a business loan. The value of this collateral is usually between 80 percent and 150 percent of the value of the loan. For example, if you borrowed $2,000 to start your farmers market vendor business, you would need to have collateral with a value of at least $1,600.

If you get a loan to purchase a fixed asset (e.g., equipment), that asset, in many cases, can be used as the collateral. Discuss collateral options with your lender. Building a good relationship with your local bank. It is important to communicate the profitability of your business and your reliability to repay your loans.

Extension agents should consider inviting a local bank or Farm Service Agency representative to discuss the lending process, cash flow statements, what they like to see in a business plan, and collateral options.

Resources

Read the Extension publication “Understanding Cash Flow Analysis” from Iowa State University for a good review of how to develop and use cash flows.

Youth interested in operating or expanding a farming business can find information regarding youth loans from the Farm Service Agency.

Watch “The Basics of Starting a Small Business” to learn about commercial financing/lender requirements and other important concepts of owning a business.

References

Hofstrand, D. (2022). Types and sources of financing for start-up businesses. Iowa State University Extension and Outreach. Ag Decision Maker.

University of Maine Extension. (2008). The home-based business fact sheet: Capital sources for your business. Adapted for Maine from Iowa by Jim McConnon.

LaPorte, J. (2019). DEMaND: Developing and educating makers and new decision-makers. Michigan State University Extension.

University of Missouri Extension Center for 4-H. (2008). 4-H business startup guide.

The University of Tennessee Agricultural Extension Service. (1996). YE$ youth entrepreneurship. PB1554.

This publication is part of the Growing Your Brand Youth Farmers Market curriculum.

The information given here is for educational purposes only. References to commercial products, trade names, or suppliers are made with the understanding that no endorsement is implied and that no discrimination against other products or suppliers is intended.

Publication 3970 (POD-02-24)

By Elizabeth Canales, PhD, Associate Professor, Agricultural Economics; Rachael Carter, PhD, Extension Specialist, Government and Community Development; Courtney Crist, PhD, Associate Extension Professor, Food Science, Nutrition, and Health Promotion; Lauren-Colby Nickels, former Extension Specialist, Extension Center for Technology Outreach; Terence Norwood, former Extension Instructor, Extension Center for Technology Outreach; and Martin Hegwood, Assistant Extension Professor, Government and Community Development.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.